Please note, effective 1/1/18 we are no longer enrolling on Connect For Health Colorado. We have made a business decision to focus on group employee benefits and the business coverage market only. We do enroll the following overages outside of the exchange:

Cigna

Bright Health

Kaiser

Answers to Your Important Questions! Call 303-471-9424

Colorado Individual Health Insurance for Solopreneurs and Startups

Subsidy Eligible Instructions: http://www.denvertechinsurance.com/files/Connect For Health Colorado Individual Instructions.pdf

Connect For Health Colorado Clients (On Exchange)

Groups of 2 or more W-2 Employees Please Click Here: Colorado Small Group Health Insurance

The information below needs updating but may be helpful for folks who are trying to decide to call for help with Group Health Insurance or if they should enroll through the exchange.

—————————————————————————————————-

Individual/Family Health Insurance: Do You Qualify For The Colorado Health Care Marketplace/Exchange? Scroll down to see the chart for qualification and subsidy.

Connect for Health Colorado 2019 rates will be available early November 2018. The rate increases for current ACA Compliant plans will most likely range between30-50% depending on the insurance company.

Open enrollment both ON and OFF EXCHANGE for Colorado residents needing individual/family health insurance plans re-opens on November 15th, 2018 and closes on December 15, 2018. Colorado residents needing help with renewals or shopping for new coverage may request help

November 15th Open Enrollment Season’s Guide to Shopping for New Coverage

The step by step guide below helps you quickly see what programs you may be eligible for that can reduce health insurance premiums and how to get ACA compliant health insurance through the exchange at the best rates available when the exchange re-opens on November 15th, 2018.

Depending on household income, you very well may be eligible for federal subsidies that immediately reduce your health insurance premiums. Theses subsidies are Advance Premium Tax Credits. They are NOT available to people eligible for Medicaid or Medicare or who have affordable coverage available through an employer.

Advance Premium Tax Credits are based on (1) the size of your household and (2) your household’s estimated income for 2018

Step 1. Determine Size of Your Household

| DO Include | DON’T Include |

|

|

Step 2. Estimate Your Household Income

You will have to provide an attestation of your expected household income in 2015, which is verified by the exchange with documentation from your most recent tax return, with consideration for reasonable changes. Married couples MUST file jointly in order to get thetax credit.

To estimate your 2015 household income, add the total income from the sources below for (1) you and your spouse and (2) any dependents who make enough money to be required to file a tax return:

DO Include: Wages, Salaries & Tips, Income from self-employment or business, Unemployment compensation, Alimony, Social Security payments, including disability payments, Income from investments, retirement, pensions & rental income, Other taxable income such as prizes, awards, and gambling winnings.

DON’T Include: Child support, Gifts, Supplemental Security Income (SSI), Veterans’ disability payments, Workers’ compensation.

Keep in mind that the Advance Premium Tax Credits are based upon your household’s Modified Adjusted Gross Income. The tax credits will be reconciled when you file your 2014 federal income taxes, so try to be as accurate as possible. Material mid-year changes in income should be reported by calling Connect for Health Colorado’s customer service department so they can make adjustments on the fly.

Modified Adjusted Gross Income (MAGI) = Line 4 on a Form 1040EZ

Line 21 on a Form 1040A

Line 37 on a Form 1040 Include:

|

Deduct:

|

Note: Do NOT include Supplemental Security Income (SSI), Veterans’ disability payments, workers’ compensation or child support received. Pre-tax contributions, such as those for child care, commuting, employer-sponsored health insurance, flexible spending accounts and retirement plans such as 401(k) and 403(b), are not included in AGI but are not listed above because they are already subtracted out of W-2wages and salaries

-

Non-taxable Social Security benefits (Line 20a minus 20b on a Form 1040)

-

Tax-exempt interest (Line on 8b on a Form 1040)

-

Foreign earned income & housing expenses for Americans living abroad (calculated on a Form 2555)

Step 3. Eligibility for Advance Premium Tax Credits or Medicaid

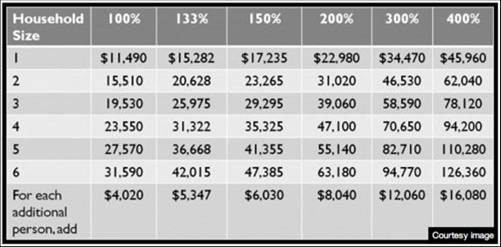

The chart below is for the 2014 Federal Poverty Levels. Go down to the correct row for Household size using the number of people in your household from Step 1 and then see where your estimated household income from Step 2 falls.

Tip: You can estimate your Advance Premium Tax Credit with the Subsidy Calculator tool.

Advance Premium Tax Credits are available to people with household Modified Adjusted Gross Income between 133% and 400% of federal poverty level. The tax credits operate on a sliding scale, so the higher the income, the lower the tax credit.

If you make below 133%, you should be eligible for Medicaid. If you make over 400%, you’re not eligible for an Advance Premium Tax Credit. Advance Premium Tax Credits are not available to people eligible for Medicaid or Medicare or who have affordable coverage through an employer.

However, you can use Connect for Heath Colorado to get private insurance with or without the Advance Premium Tax Credit as well as to enroll in Medicaid, as you’ll see in the following step.

Step 4. Applying for Cost Saving Programs, Determining Your Monthly Premium & Getting Covered

Connect for Health Colorado is Colorado’s health insurance exchange and it is the only place you can get a tax credit to reduce the cost of your health insurance. However, you can still get health insurance through the exchange, even if you don’t qualify for or want the Advance Premium Tax Credit.

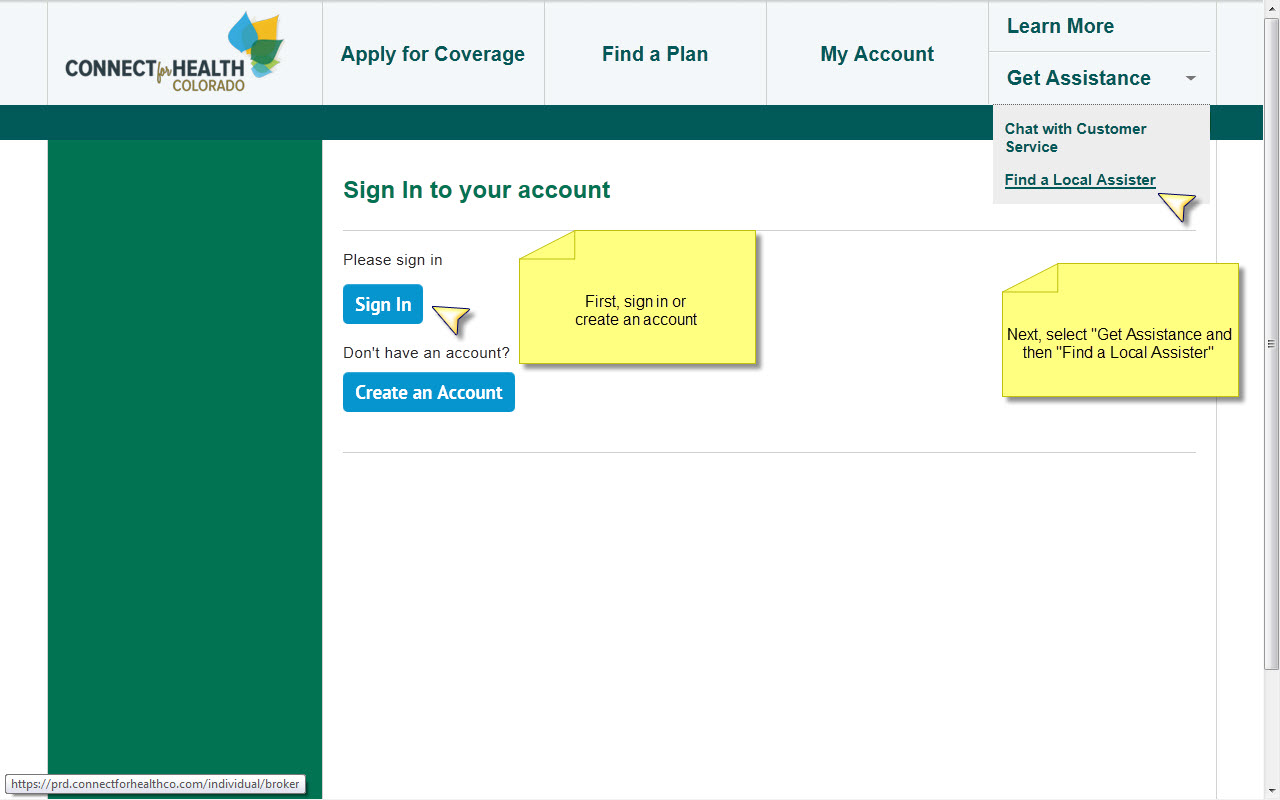

First, go to Connect for Health Colorado and Create an Account or Login if you already have one. Next, authorize me as your Certified Agent on the exchange. This only takes seconds and is required before I can help you with your new insurance plan, answer questions and service your account going forward. There is no charge or extra cost for my services. I am paid a small commission by the insurance companies which helps us keep the lights on and provide resources like this to serve the community.

To summarize, go to Connect for Health Colorado. Create an account or login. Then, as shown in the picture below, from the “Get Assistance” tab, select “Find Expert Assistance in Your Community.”

Next, authorize me as your Certified Agent on the exchange. There is no charge or extra cost for my services and you MUST do this if you would like my personal help. It only takes seconds and your support helps me provide resources like this to serve the community.

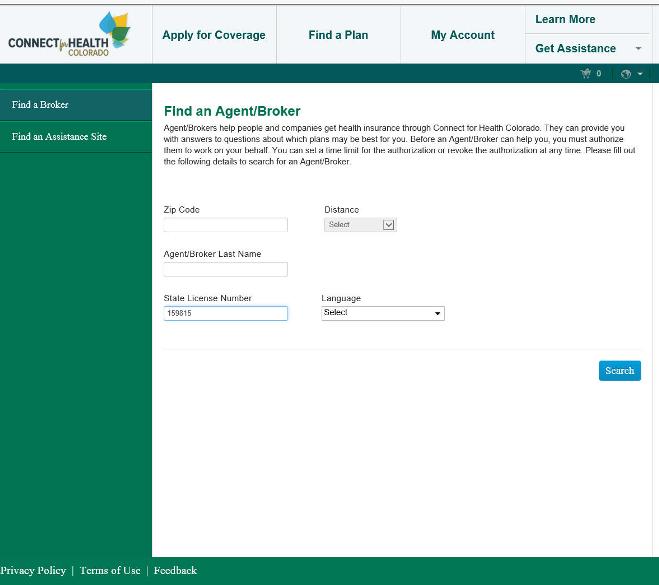

Next, click on the “Continue” button for “Agent/Broker” and THEN Enter Stacey Gilbert’s Insurance License Number: 159815 – Thank you!!

Click on Stacey Gilbert’s name and then Select “Authorize.”

Make a note of Stacey’s phone number and email address after clicking on her name or print the page. After authorizing Stacey Gilbert as your Agent, you are then welcome to contact Stacey for personal assistance. There is no charge or extra cost for doing so. Please note that November 1-Dec 30 are peak times for open enrollment. Stacey will be checking email and phone calls regularly and will respond as soon as possible.

Final Step: Connect for Health Colorado’s 3 Primary Paths

Based on where your household income relative to the size of your household, 99% of people will go down one of three possible tracks.

Track 1) Obtaining Advance Premium Tax Credits: If your income is between 133% and 400% on the chart from Step 3 then to get the Advance Premium Tax Credit, you must first apply for Medicaid using the PEAK system and be denied. After you are denied, the PEAK system will provide you a denial code. The denial code is required to apply for the Advance Premium Tax Credit.

It typically takes anywhere from getting an instant response to 2 weeks to get a Medicaid denial code from the PEAK system. The more accurate and complete your Medicaid application is, the less time you’re likely to have to wait. You can call 800-359-1991 or 800-221-3943 between 8:00 a.m. and 6:00 p.m. Monday-Friday to check the status of your Medicaid application. You’ll need to provide your Application Tracking Number, which was provided on the final screen of the PEAK system’s online application.

After getting your Medicaid denial code (7-digit number that starts with 1B) from PEAK, then log back into Connect for Health Colorado, click the blue “Eligibility” button, enter the denial code and complete your application for the Advance Premium Tax Credit. This takes about 20 minutes and once that is done then you will be able to browse plans and see the final premiums, for all plans offered, less the Advance Premium Tax Credits you qualified for. Then simply add the chosen plan to your shopping cart and check out.

Money Saving Reminder – If your household income is between 133% and 250% of the Federal Poverty Level be sure to check the Silver plans, as they may have very attractive cost sharing reductions like lower deductibles and out of pocket maximums. You’ll only find these on the silver plans. Cha Ching!

Track 2) No Advance Premium Tax Credit: If your income is above 400% on the chart from Step 3, if you have affordable coverage available through your or a spouse’s employer, if you do not want to go onto Medicaid, if you are eligible for Medicare, or if you don’t want to take the tax credit in advance, then you can select the option at Connect for Health Colorado’s website to skip determining eligibility for premium assistance. Then it’s simply a manner of browsing the plans, adding the chosen plan to your shopping cart, filling out a brief application and checking out.

Slicing Through the Red Tape – Some people prefer toskip the exchange’s financial disclosure requirements to get an Advance Premium Tax Credit and instead wait and get the tax credit when filing their 2014 federal income taxes. The tax credit is then provided as an increased refund or reduction in taxes owed. This can be a safe choice for people whose income fluctuates during the year or just want to avoid red tape. However, you still must apply through the exchange to get the tax credit! Just skip the Medicaid application and Advance Premium Tax Credit applications.

Track 3) Getting Medicaid or CHP+ Coverage: Simply apply for Medicaid using the PEAK system. You can do this at Medicaid or go directly to www.colorado.gov/peak. You will be notified if you are eligible for Medicaid or CHP+. If you have been determined eligible for Medicaid your application data will be transferred to the State of Colorado and will then be handled according to state policies. FYI: I’m not able to help with Medicaid issues, so for ALL questions about Medicaid or CHP+ or to appeal their decisions call 800-359-1991 between 8am and 6pm Monday-Friday. You can see Colorado’s Medicaid plan benefits here and look up providers here.

Most Popular Question About Medicaid – What if I qualify and don’t want it? If you are eligible for Medicaid, you can still apply for private insurance plans through Connect for Health Colorado, but you will be ineligible for a tax credit and will pay the full cost of the monthly premiums.

Upcoming Deadlines and Penalties

Not having health insurance can result in a tax penalty of $95 or 1% of your income – whichever is higher. Open enrollment will re-open on November 15th, 2014

Open Enrollment and Special Enrollment Periods

After Open Enrollment closes people that buy their own health insurance will no longer be able to purchase Affordable Care Act compliant health insurance, either inside or outside of the health insurance exchange until Open Enrollment reopens next November 15th. Exceptions apply if you have a qualifying event such as marriage, birth or adoption of a child, divorce, moving out of a service area, or involuntary loss of coverage. Please note that not paying a bill doesn’t count, so don’t let insurance coverage lapse.

You can also get instant online quotes, for select on and off-exchange 2014 plans, so you can easily see and compare rates on Colorado health insurance plans from many of Colorado’s leading health insurance companies.

In addition to handling technology coverage, as a part of Consolidated Benefits, Inc., we are your Connect For Health Certified Broker with over 15 years of experience with Health Insurance and Employee Benefits to the Fortune 100 level! Experience includes working for two different health insurance companies. Why me? It’s not just the years of experience. My mission is to find you the best solutions, make sure you are fully covered and SAVE you money. Every coupon, discount and tax credit….I’ll find it for you! Scroll down to UNIQUE issues for Startups!

Frequently Asked Questions:

Do You Qualify For The Colorado Health Care Marketplace/Exchange? Scroll down to see the chart for qualification and subsidy.

Who must use the Connect For Health Colorado exchange? No one is required to use the exchange. However, small businesses and individuals can only receive federal tax subsidies if they sign up for insurance through the exchange.

What Are My Options If I Do Not Qualify (based on income) For the Marketplace/Exchange? There are many options that we can help you with for coverage that meets the ACA guidelines outside of the Colorado Healthcare Exchange. You will have a variety of insurance companies and plan designs to choose from, you just will not be eligible for a subsidy from the exchange. See the chart below

Why Do I Need A Broker? How does a Licensed Broker differ from a Navigator on the Colorado Healthcare Exchange? A licensed broker must go through 40 hours of classroom time to obtain a life and health license. Most Licensed Brokers (some go by the title “agent”, especially if they are “captive” to one company) have years of industry experience and understand health insurance policies because they have been selling them for many years. Brokers have knowledge of the plan designs, the networks, how coverage works in and out of network, which plans and companies have limitations on certain benefits and which ones have richer benefits. They can also visit with you about how a plan might cover certain health conditions and be able to advise that one company and or network might help you better than another because of the years of working with these insurance companies. To work with the Colorado Healthcare Exchange in addition to handling life and health plans outside of the exchange, a broker must go through online and classroom training to be a “certified broker”, listed on the Colorado Healthcare Exchange website and certified to work with you. Brokers also know the history of the companies when it comes to rate increases on blocks of business or even if the company has pulled out of certain markets. A broker can find you coverage if you are not eligible for the exchange. A broker is paid by the insurance company either way so it costs you the client nothing to assign a broker and work with that broker.

A Navigator is a new title bestowed upon employees hired by the Colorado Healthcare exchange in an attempt to have some people in an office fielding calls from the public for the over 1/2 million people that will now be flooding the marketplace looking for coverage that were previously not covered. Many of these employees are new to this field, are temporary or seasonal to this open enrollment period and do not have the years of knowledge to answer your questions. Navigators are NOT licensed insurance brokers/agents, they cannot advise you about an insurance plan (it’s against the law as they are not licensed agents or brokers), they can only help you set up your account if you are having a technical glitch, help you see if you qualify for a subsidy or Medicaid and refer you to links to look up providers. Navigators are on a 1-800#, are not allowed to call out, or call back. It’s a call center with a different person answering each time you all. The Colorado Healthcare exchange is advising most folks coming to the exchange to pick a broker as they do not have the staff to field all the calls. Since the original start of Connect For Health Colorado, the grant money for Navigators has dried up. There are a handful of these individuals helping mostly at community centers during open enrollment.

How Do Health Insurance Plans Differ Inside and Outside of The Colorado Healthcare Exchange? Insurance companies have filed plans both inside and outside of the Colorado Health Care Exchange. The plans for individuals inside the exchange are mostly HMO except for one insurance company and in most cases have a smaller network of MD’s and hospitals.

Is My Doctor/Hospital On the Network? Some of the insurance plans on the Colorado Healthcare Exchange have limited networks for both doctors, specialists and hospitals. Please make sure when you look at networks online that you are choosing 2014 and “exchange” to make sure the MD or hospital is in the network if it’s an “exchange” insurance plan.

This is an IMPORTANT QUESTION-Please Read!I Travel Around The US For Work…What are my best options for coverage? AND/OR, I have a health condition and want the best care (cancer, heart, neurological, etc.), I run marathons or I am involved in sports nationwide: Although an HMO is supposed to cover you in an emergency when you are out of town, some HMO’s will require you to return to the area to receive care once you are stabilized. If you have two employees in a group you are better off creating a group plan.

In addition, you lose choice when you choose an HMO. Let’s take an example, 6 months into a plan, you come down with an odd type of cancer and the oncologist in Denver tells you your best shot at treatment is a new drug only available at MD Anderson Cancer Center in Houston or your heart specialist in Denver says you need a valve replacement and the best care is at Cleveland Clinic. With an HMO you have to submit to a Medical Director (the dreaded “death squad”) and he/she and a board sit every week to decide if they are going to provide treatment outside of the realm of the HMO contract. I worked for an HMO and used to visit with our in house MD. This is not the government making these choices (regardless of what has been in the media)…. it’s your choice to give that power to them when you choose the HMO. It’s only in very unique circumstances that you get approved. I am sharing this because YOU want to have the option to get on a plane and from the time you land know that all your cost are covered either in network (because it’s a national network like Cigna with Centers of Excellence coverage) or under an out of network benefit to the annual cap on your policy (even if it means $15000-$25,000 out of your pocket vs. a medical director stamping “denied” and 100% out of your pocket. These are life and death decisions most people just don’t think about when they are selecting a policy and you will not be able to “switch” mid year as it’s adverse selection for an insurance company.

If you are a family with a child living outside of Colorado, again a PPO with a National network will be your best option.

How much is the tax subsidy for health insurance coverage for Individuals? Tax subsidies will be set based on a person’s income level, his or her location and age. Subsidies will be greater for older Coloradans. A single person making from 133 percent to 400 percent of the federal poverty level will be eligible for a tax subsidy. A person making less than 133 percent of the federal poverty level will be covered by Medicaid, he said. The 133 percent-of federal-poverty-level amount is about $13,000 for a single person. An example from the U.S. Treasury Department: A family of four with an income of $50,000 would be expected to pay no more than $3,570 toward health insurance, under new rules. If a health insurance plan on the exchange turns out to cost $9,000, then the family’s subsidy would be $5,430 ($9,000 – $3,570).

How do you receive the tax subsidies? The tax subsidy on health-insurance premiums bought through the exchange can be received every month starting Jan. 1, 2015. Subsidies also can be received through tax returns filed at the end of the year. Please scroll down to the bottom of this page to see an example subsidy chart for individuals and families. This is subtracted off your premium.

I am experiencing technical problems with the Colorado Healthcare Exchange? What’s going on and can you help me?The exchange is new, it’s clunky and has numerous problems with error messages. There have been statements made on CNN and Fox News that nationally, it’s questionable about what is going on with the data that has been entered. It’s one of the reasons you want to have a broker involved as an extra person to make sure your coverage is entered and approved. The broker will make sure that your coverage is in place and follow up with the exchange to get reports on approval for coverage, proof of coverage and making sure you get your new insurance ID card.

When is open enrollment for Individuals? Individuals will have from

November 15 1, 2018 to December 15, 2018 to purchase a qualified health plan on Connect for Health Colorado for a January 1, 2019 effective date.

Generally individuals will only be able to purchase individual plans curing open enrollment each year unless one has a loss of coverage qualifying event, ie: loss of group coverage, divorce, cobra exhaust etc.

What health insurance companies are on the Colorado Healthcare Exchange?

- Anthem (HMO Colorado and Rocky Mountain Hospital & Medical Service) (Individual & Small Group)

- Bright Health

- Cigna Health and Life Insurance Company (Individual) PPO

- Denver Health Medical Plan HMO (Individual) (note this is limited to Denver Health and associated hospitals)

- Kaiser Foundation Health Plan of Colorado HMO (Individual & Small Group) (note this is limited to Kaiser clinics and Kaiser contracted hospitals)

What health insurance companies are writing coverage OUTSIDE the Colorado Healthcare Exchange?

- Anthem PPO and HMO

- Bright Health New for 2017

- Cigna PPO Individual/Family (Groups of 20+)

- Kaiser Permanente HMO (Individual and Group 2+)

- Humana Individual and Group (HMO and PPO-Group 2+)

- United Healthcare Group (HMO/PPO Group 2+)

All the questions about health insurance

and health care reform have me thinking about all of my coverage. What other

options are available to help my family and I round out our coverage and fill

the gaps?As your broker, we can look at all the coverage you currently have in place and supplement your health insurance where needed. Items we think should be reviewed/audited yearly:

- Are you and/or your children active in sports, sports leagues, skiing, mountain biking, dirt biking, etc? Have you experienced a sports injury? What did you pay for a broken bone or surgery for a torn ACL? Accident coverage is inexpensive and helps pay your deductible with the high deductibles on these new health insurance plans.

- Do you have adequate life insurance in place? A good rule of thumb is to have a minimum of ten times your salary and if you plan on sending kids to college and your spouse does not have nearby help should something happen to you, I like to use the rule of $500,000 to $1 million for each child you have to fund care and the income lost over the many years you are gone to take care of that college funding. (ASK STACEY her personal story of a friend in Texas and how $1 million gave one of her closest friend’s the ability to grieve and take care of two bright girls (that are on a path to Hollywood today with one in an ABC Family movie this fall) when she was unable to find a job after a lay off and her ex died in a tragic DUI hitting him).

- Do you have disability coverage? SSDI does not kick in unless you are almost a vegetable and can take 2 years to qualify for usually a $800-$1000 amount. Can you live on this?

- Does cancer, heart disease or diabetes run in your family? Critical Illness coverage is a popular option to help cover high deductibles and cover the cost of non medical items, travel for treatment and the peace of mind to have extra cash on top of your (60%) short term disability payment to pay your mortgage and utilities while you recover.

- Are you over 50 and have you experienced the cost of and extended care facility with a parent or grandparent? It’s over $70,000 a year today. There are some great options that you can lock into with hybrid products that combine life insurance and long term care and help protect your nest egg.

- Do you have a health condition and know you can’t qualify for life insurance or long term care coverage? We have excellent short term care policies that are under $1 a day in cost that pay a daily benefit for home health care only for one year and the app doesn’t ask a lot of questions.

Small Business SHOP Group Plans (2-50): Note effective 1/1/18 only Kaiser Group is available through Connect For Health Colorado

How much is the tax subsidy for health insurance coverage for small businesses?

Employers with 25 or fewer employees who make an average of $50,000 or less per employee can receive up to a 50 percent tax subsidy for their contributions to an employee health plan. Employers with the fewest employees and the lowest average salaries will benefit the most from the federal tax subsidies. A Small Business Tax Credit Calculator to help you get a better idea of how it will work. Please call 303-471-9424 for a copy.

I have a Small Group with Less than 25 employees and qualify with most of our employees making an average wage under $50,000. How do we benefit with a group plan through the SHOP vs. letting our employees purchase with a subsidy?That’s where a picking a broker who understands employee benefits is crucial. The broker can do a comparison and look at how individual coverage with subsidy compares with small group coverage inside the exchange. Although it may look better for some employers with extremely low wage earners to have their employees purchase with a subsidy through the individual exchange, take a look at both sides.

Before you decide to “dump” your current small group insurance plan or if you are a start up that was thinking of adding small group health insurance think about a couple of items:

1. A group plan is more benefit rich and compared with individual plans on the exchange offers more options to your employees. Currently, there is only ONE PPO option on the individual exchange, all other plans are HMO only. The individual exchange offers a “thinner” network of doctors and hospitals compared with group insurance plans and plans outside of the exchange so will limit coverage and care to employees.

2. A small group health plan will help you to attract and retain quality employees and compete with larger businesses for these employees. A small group health plan shows current and new employees that you care about them.

How does the SHOP tax deduction work and do we have to purchase through the exchange? The credit is available only for plans purchased through SHOP exchange. Businesses will qualify for the tax credit based on their annual wage base and number of employees. Businesses still can deduct the rest of premium costs not covered by the tax credit from its annual tax bill.

Although businesses can enroll in the SHOP it is highly recommended to work through a certified broker on the exchange for coverage. All Colorado brokers work through one of two managing general agencies that have a slick software program (that have been creating these group quotes for many years) that will take your census data and provide a quick spreadsheet of plans designs and premiums with links to brochures embedded in the spreadsheet to make it easy for you to choose. The two MGA’s have been certified by the Colorado Healthcare Exchange (along with their brokers) and have been assigned this task to take the load off of the staff at the exchange as they are experienced and provide an excellent experience for small groups.

The broker will listen to what you want to offer (PPO vs. HMO, your past experience with insurance companies, etc) and narrow this down before sending it to you because there are over 100 options and it can get confusing. If you decide to DIY you are completely on your own. Their staff is not legally able to answer questions about insurance plans as they are not “licensed agents”. They only help with technical items. They also are not able to help you with compliance. If you do not qualify for the Colorado Health Care Exchange the broker will find you other small group options through their MGA. This would be a wage base of over $50,000 a year (example: group of mostly doctors or IT professionals).

Coverage must be offered to every employee who works full-time, under the federal rules, which considers full-time as anyone working 30 hours or more a week.

How do I know if the business will receive a tax credit?

Which companies are writing Small Group Health Insurance in Colorado for 2 or more employees? For Community Rated Coverage (pre-exisiting conditions accepted)

In the Denver/Boulder/Colorado Spring Region: (1) Humana’s HMO and PPO (2) Kaiser Permanente HMO, (3) Anthem Blue Cross HMO/PPO, United Healthcare PPO and HMO.

In Summit and Eagle Counties (1) Anthem Blue Cross HMO and PPO (2) Humana PPO (3) Kaiser Permanent HMO, (4) United Healthcare PPO Mountains outside of Summit and Eagle County: All the same except no Kaiser Plan

What other options are available to provide corporate benefits to help me retain and attract employees? When an employer installs a small group health insurance plan, dental, vision and group life are easier to add and there are less pre-existing limitations for some coverage’s in a group environment.

I have a young, active and healthy group of employees with no major health conditions. We have had group health insurance for a few years but find the rate increases to be outrageous. What can we do to minimize our costs? We have creative products for healthy groups who are able to “medically qualify” for a partially self-funded health insurance plan. Premiums can be 20-40% less than the guarantee issue plans on the fully insured market and if you have a year with few claims, you may qualify for a “participation in the claims fund” in the form of a refund of some of the claims part of the premium or a premium holiday for employees. This option is only useful for HEALTHY groups who can make it through medical underwriting and have over 10 employees.

What if I’m self-employed? People who are self-employed with no employees can use the individual marketplace for insurance coverage. Business group of “one” is no longer available after 1/1/14 because of the availability on the exchange. The federal government considers a person self-employed if he or she runs an income-generating business but has no other employees. Independent contractors do not count as employees, under federal guidelines. And there are new options under the ACA. Starting Oct. 1, people who are self-employed can go to Connect for Health Colorado to compare features of plans, determine premiums, deductibles and out- of-pocket costs before enrolling. No one is denied coverage based on pre-existing health conditions. People with individual insurance policies might be able to switch to a marketplace plan. Based on annual income, the monthly premiums could be lower

UNIQUE ISSUES FOR COLORADO STARTUPS

You are a start up on the verge of launching. Should you start a group health insurance plan? That depends on a a variety of factors.

1. Is it a family business where you are sharing in the profits, putting everything back into building the business and paying out a low wage base the first few years and looking to write everything off? Then yes, you may want to start a group insurance plan as you’ll most likely have a 50% tax credit on the 100% employee premium you intend to pay.

2. Is it a business with highly paid workers such as a group of software developers? If your average wage base is over $50,000 your employees will not qualify for an individual subsidy in most cases and a small group plan helps you to attract and retain workers when you are competing with big companies offering the same. Having a plan where you are paying a part of the premium for the employee shows you care, especially since they get no tax break on the new plan.

Unemployment is low right now and employers are doing

everything they can to attract top talent.

3. Is it a small business with mostly lot of lower paid workers making minimum wage or an average of less than $30,000 a year? We’ll have to do an analysis as they may qualify for a subsidy that will pay most of their premium on the individual exchange.

4. It is a business that is starting up and will probably be sold within 6 months to a year? You probably want to wait unless it’s all highly paid workers that have no benefit and no tax break from the exchange. They will be looking to you to help with premiums.

You have a few employees and don’t want to deal with payroll anymore. Where do you go? We have a referral partner that will save you hundreds to thousands a year on your payroll and HR services. Example: Technology Company with 12 workers, analysis of a big payroll company had them paying $5000 more a year than our partner for running payroll and HR they never utilized.

We also have pay as you go Workers Compensation and Business Owners Policies for new companies. One of our WC carriers has a 10% discount if you have coverage with a partner health insurance company. Did you know that officers of companies may be able to opt out of Workers Comp? Ask us how!

Colorado Small Group Health Insurance